What Does Offshore Wealth Management Do?

Wiki Article

Some Known Details About Offshore Wealth Management

Table of ContentsA Biased View of Offshore Wealth ManagementThe Offshore Wealth Management PDFsThe Best Guide To Offshore Wealth ManagementUnknown Facts About Offshore Wealth ManagementThe Main Principles Of Offshore Wealth Management

If you are wanting to offshore financial investments to help protect your assetsor are interested in estate planningit would certainly be sensible to discover an attorney (or a group of lawyers) specializing in property protection, wills, or company sequence. You require to take a look at the financial investments themselves and also their legal and also tax effects - offshore wealth management.For the most part, the benefits of overseas investing are surpassed by the remarkable expenses of professional fees, payments, and traveling expenditures.

Jersey is an offshore location with ingrained ties to our impact markets. With large industry understanding in wealth monitoring and monetary structuring, Jersey is considered as among the most established and well-regulated overseas economic centres worldwide.

Things about Offshore Wealth Management

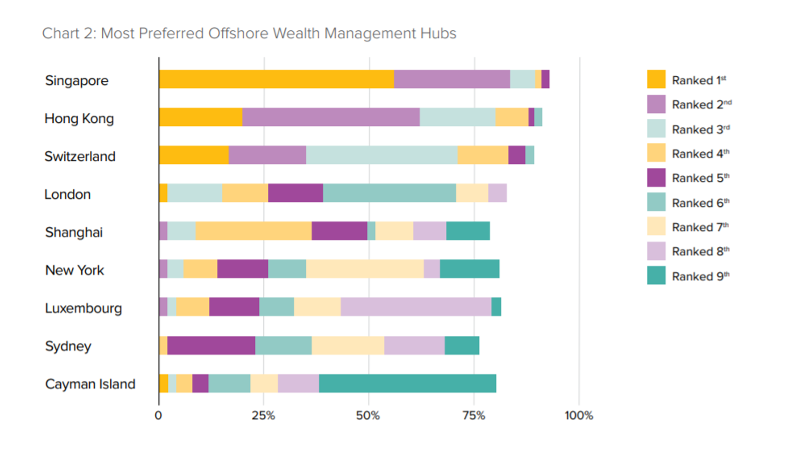

Checklist of Figures, Number 1: Offshore possessions surged early in the pandemic as capitalists looked for safe houses early on and after that sought out investment possibilities, Figure 2: The tidal wave of non-resident wealth right into Europe is declining, Number 3: The central functions of New york city and London remain even after riches drains pipes from in other places in the regions, Figure 4: Asia-Pacific is when again back to driving development in the overseas market, Number 5: Unfavorable macroeconomic 'push' factors are driving the boost in HNW offshore investment, Number 6: Australian investors that are eager to directly own a trendy tech stock are being targeting by moomoo, Number 7: Privacy and also tax were largely missing as drivers for offshoring throughout the pandemic, Number 8: Financial institutions dramatically raised their hiring for policy and compliance in the very early months of 2022Figure 9: Regulation-related job working with from Dec 14, 2021 to March 14, 2022 contrasted to previous quarter, Number 10: The North American market is well provisioned with offshore services, Figure 11: Money danger has actually expanded over the last ten years as well as is increased in times of situation, Number 12: The majority of exclusive wide range companies in the US and Canada can link clients to overseas partners, Number 13: Citibank's overseas financial investment alternatives cover numerous possession courses, Figure 14: ESG is equally as important as high returns in markets that Criterion Chartered has presence in, Number 15: Requirement Chartered's worldwide service accommodates both liquid as well as illiquid offshore financial investments, Number 16: HSBC Premier India services concentrate on international privileges and also NRIs (offshore wealth management).There are lots of, as well as the adhering to are just a couple of examples: -: in numerous nations, financial institution deposits do not have the same defense as you may have been made use of to at house. Cyprus, Argentina as well as Greece have actually all provided instances of financial situations. By using an offshore financial institution, based in a very regulated, clear jurisdiction with statutory securities for investors, you can feel safe in the knowledge that your money is secure.

A partnership manager will certainly constantly give an individual factor of contact that ought to put in the time to understand you and also your needs.: as an expat, being able to maintain your financial institution account in one location, no matter how numerous times you move nations, is a major advantage. You additionally know, no matter where you are in the globe, visit this page you will certainly have access to your cash.

The 5-Minute Rule for Offshore Wealth Management

These variety from keeping your money outside the tax web of your home country, to protecting it from tax obligations in the nation you're presently staying in. It can likewise be helpful when it involves estate planning as, depending upon your nationality and tax status, possessions that rest in your overseas checking account may not go through estate tax.

Investing via an overseas financial institution is straightforward and there is generally advice or tools handy to help you produce a financial investment profile suitable to your risk account and also the outcomes you want to attain. Investing with an offshore checking account is usually a lot more versatile as well as transparent than the alternatives that are traditionally utilized.

You can make use of these benefits by opening up an offshore bank account. It is a basic as well as fast procedure. Some economic consultatory firms, like AES International, can open an overseas personal savings account for you within 48 hrs, offered that all the demands are met.

Offshore Wealth Management for Dummies

Before you invest, see to it you feel comfy with the level of danger you take. Investments objective to grow your cash, but they may lose it too.This is being driven by a strong desire to move towards sophistication, based upon an approval of foreign proficiency in regards to products, solutions and processes. In India, meanwhile, the vast quantity of brand-new wide range being produced is fertile ground for the ideal offering. According to these as well as various other regional patterns, the meaning as well as extent of private financial is altering in most of these regional markets in addition to it the requirement to have accessibility to a bigger range of product or discover here services - offshore wealth management.

Things about Offshore Wealth Management

International players require to take note of some of the challenges their counterparts have dealt with in certain markets, for instance India. The majority of international organizations which have actually established up a business in India have actually attempted to follow the same version and also style as in their home nation.

Report this wiki page